The Buy Box is a fortnightly series from Thesis Driven spotlighting an emerging/growing real estate trend + sponsor. For QPs & institutional investors only.

Join us next Wednesday, December 10th at 3pm for a 60-minute Buy Box Live Q&A with Aptitude Development.

We’ll highlight their upcoming projects + 💸 investment opportunities.

Aptitude is the team behind The Marshall—a growing national platform building and operating ground-up purpose-built student housing (PBSH) in Tier-1 markets. We’ll unpack the opportunity, walk through two of their current projects (ASU & SUNY Binghamton), and explore how integrated development + management platforms are reshaping student housing as it institutionalizes.

Note: if you register but cannot attend, we will send you a recap & recording via email. More details below.

Student Housing OpCo/PropCo: A Deep Dive on Aptitude

Date & Time: Wednesday, December 10 | 3:00 PM – 4:00 PM ET

Hosted by: Thesis Driven

Audience: Accredited & Institutional Investors

Description

For years, purpose-built student housing (PBSH) at large public universities was treated as a niche category—an afterthought to conventional multifamily. But on Tier-1 campuses like ASU, Michigan, NC State, and SUNY Binghamton, the opposite has happened: enrollment has climbed, walkable land has tightened, and modern student expectations have diverged sharply from the aging off-campus stock.

The result is one of the most compelling residential opportunities of the next decade: user-designed, professionally operated housing platforms serving a cohort that evaluates their homes not just by square footage, but by routines, community, wellness, and service.

Join us for a 60-minute Buy Box Live Q&A with Aptitude Development, the team behind The Marshall—a growing national platform building and operating ground-up PBSH in Tier-1 markets. We’ll unpack the opportunity, walk through two of their current projects (ASU & Binghamton), and explore how integrated development + management platforms are reshaping student housing as it institutionalizes.

Aptitude has spent the last decade building track record while developing one of the most focused pipelines in the sector. By targeting campuses with high enrollment growth, persistent supply-demand imbalances in pedestrian locations, and parent-backed leasing structures, Tier-1 PBSH now delivers the yield, operating consistency, and exit liquidity that institutional investors increasingly demand.

In this session, Paul & Brad of Thesis Driven will sit down with Jared Hutter (Co-Founder) and Zach Feldman (Partner) to break down the model, the pipeline, and the broader opportunity in user-driven residential platforms.

In this session, we’ll cover:

Why Tier-1 PBSH has become a structural opportunity

How Aptitude underwrites markets like ASU + Binghamton

The Marshall: why integrated ops drive 100–200 bps of UYOC uplift

The economics: bed/bath parity, rent-per-SF arbitrage, exit caps

The platform: a decade of PBSH development now scaling nationally

How investors are underwriting the next generation of residential brands

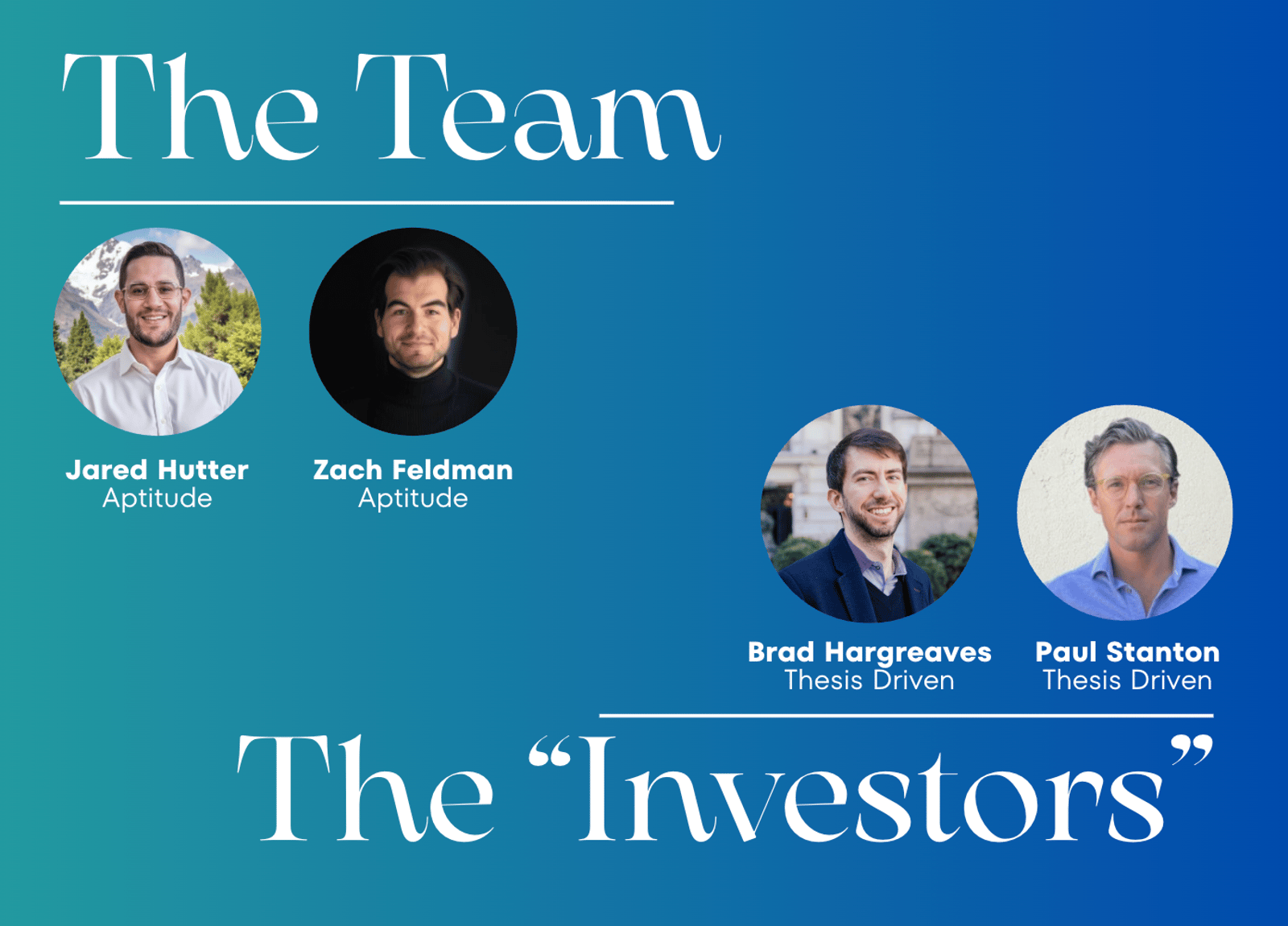

Speakers Include:

The Team

Jared Hutter, Co-Founder, Aptitude Development

Zach Feldman, Partner, Aptitude Development

The “Institutional Investors”

Paul Stanton, Thesis Driven

Brad Hargreaves, Thesis Driven

See how Aptitude is transforming a niche asset class with an institutional-scale, vertically-integrated real estate platform.