Join Thesis Driven and Groma’s founders for a live session unpacking how technology, institutional operations, and innovative structuring are opening the doors to one of the most resilient and overlooked corners of U.S. housing: micro-multifamily.

Through its tech-powered REIT, investors can now own a share of professionally managed small apartment buildings—starting with as little as $1,000.

Join the investor deep dive next Wednesday, October 22 (Register here).

Note Thesis Driven’s Buy Box series is only for accredited & institutional investors seeking to find the entrepreneurs and projects shaping the future of the built world.

About the Event

📅 Date & Time: Wednesday, October 22nd, 3:00 PM EDT

🎙️ Hosted by: Thesis Driven

🎯 Audience: Accredited & Institutional investors

Small apartment buildings—those classic triple-deckers and walkups you see across Boston, Providence, and countless American cities—make up one of the country’s most important but overlooked forms of housing. They’re home to millions, but decades of underinvestment have left them capital-starved and inefficiently managed.

Join us for a 60-minute deep dive with Groma’s founders, Seth Priebatsch and Chris Lehman, and the Thesis Driven team as we explore how Groma is reinventing ownership, operations, and access to this “micro-multifamily” sector through its technology-powered operating platform.

Backed by institutional partners and a leadership team with backgrounds in real estate, venture, and urban development, Groma is bringing modern technology, design, and capital to a housing segment that’s been stuck in the past. Their approach is part PropTech, part investment platform, and part neighborhood revitalization—built on a belief that small buildings can make a big impact.

In this session, Brad & Paul of Thesis Driven will join Seth and Chris to unpack the investment thesis, walk through Groma’s portfolio and acquisition strategy, and explore how the company is turning overlooked 2–20 unit buildings into a scalable, income-producing asset class.

In this session, we’ll cover:

🏙️ America’s “Micro-Multifamily” Gap: Why small apartment buildings are critical yet undercapitalized

📊 The Inefficiency: 150–200 bps cap rate spreads and why institutions have ignored this space

💡 The Model: How Groma combines ownership, operations, and investor access in one platform

💰 Investing in the Groma Real Estate Trust: How accredited investors can participate with as little as $1,000 through Groma’s tech-enabled Real Estate Trust

🏗️ The Execution: Technology-driven acquisitions, standardized renovations, and centralized management

📈 The Vision: Building a tech-powered REIT that makes small multifamily ownership accessible and scalable

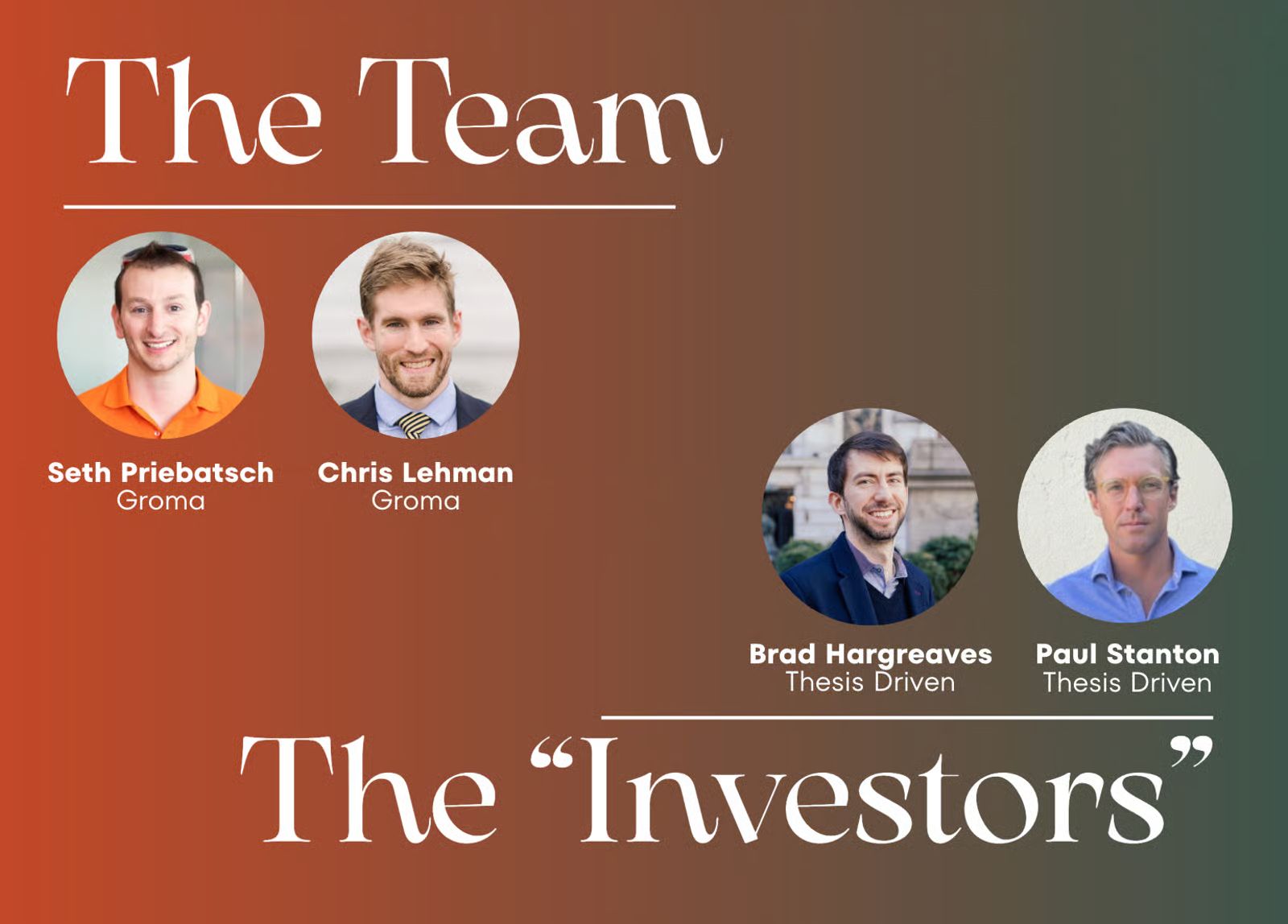

Speakers Include:

The Groma Team

Seth Priebatsch, Co-Founder & President, Groma

Chris Lehman, Co-Founder & Head of Research & Policy, Groma

The “Institutional Investors”

Paul Stanton, Thesis Driven

Brad Hargreaves, Thesis Driven

⸻

🎟️ Register now to see how Groma is transforming small apartment buildings into an institutional-quality housing platform—and redefining what it means to invest in your neighborhood.